Health systems wade into drug manufacturing with eye on reducing shortages

Health systems wade into drug manufacturing with eye on reducing shortages | Healthcare Dive

With hospitals entering pharma territory, the trend toward industry convergence continues.

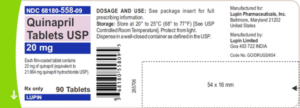

The systems’ aim is to create an FDA-approved pharmaceutical company that will either make generics directly or subcontract the manufacturing to a licensed contract manufacturing organization.

“The best way to control the rising cost of health care in the U.S. is for payers, providers and pharmaceutical companies to work together and share responsibility in making care affordable,” Laura Kaiser, president and CEO of SSM Health, said in a statement. “Until that time, initiatives such as this will foster our ability to protect patients from drug shortages and prices increases that limit their ability to access the care they need.”

Price gouging, generics manufacturers taking on off-patent drugs and increasing prices by huge amounts, has led to rising healthcare costs and problems with supply (sometimes artificially induced). A notorious example is Martin Shkreli and Turing Pharmaceuticals hiking up the price of toxoplasmosis drug Daraprim from $13.50 per tablet to $750.

Other examples include Valeant picking up Isuprel and Nitropress and increasing prices by six-fold and three-fold respectively, and Mylan hiking up EpiPen prices by more than 400%.

Drug shortages have been a recurring problem for hospitals over the past decade. For example, hospitals last spring faced a shortage of medical-grade sodium bicarbonate, forcing treatment delays and transfers of patients to better-stocked facilities. The problem started when Pfizer announced its supply of the drug was low, causing an increase in demand for its sole competitor, Amphastar, depleting its stock as well.

The industry is in a perpetual blame game over drug pricing. The systems are focusing on generics while brand-name drugs account for 72% of drug spending in the U.S. (only 10% of all filled prescriptions are brand-name drugs).

Moreover, the announcement highlights how health systems — and the industry at large — are attempting to reshape themselves.

This continues the trend, every line is being redrawn Hospitals – now generic manufacturers and insurance + risk bearers Retail pharmacy and insurance Insurers and digital therapeutics + primary care Pharma getting into outcomes and patient engagement